It's super easy! Just fill out our quick

and simple form - no hassle!

You will be connected to our lender network and they will endeavour to give you a quick answer.

Get paid fast during standard banking hours.

* Payment is subject to the eligibility criteria, terms and conditions, disbursement policy and successfully obtaining credit with the lender you apply with.

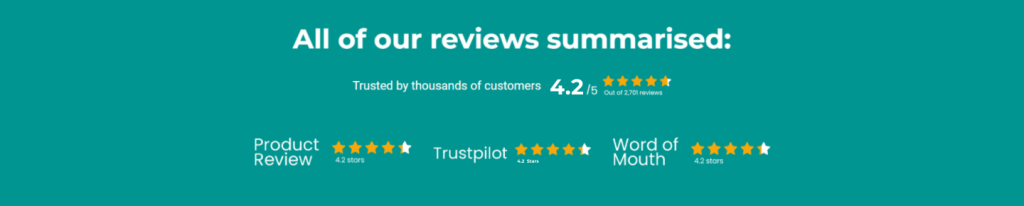

With over a decade of experience, we specialise in efficiently connecting you with tailored financial solutions to meet your needs.

Payday lenders can help by providing a short term loan to get you through to your next payday.

We believe that everyone should have access to a financial solution regardless of past credit history.

If you need a little support between your Centrelink payments, we may be able to connect you with a provider who can help.

Need cash to cover unforeseen expenses? Cigno may be able to connect you to a provider that can help you.

Want to use your upcoming tax return a little early? Tax refund advances give you a little more flexibility when you're relying on your return to cover urgent expenses.

Got bills due before your next payday? Take care of them with a cash advance and keep your finances on track.

Cigno's fully online, automated process is quick and easy. We can connect you with a provider 24/7.

Support yourself financially between jobs with a small cash loan. Get back on your feet with Cigno.

Need money urgently? Don't wait for a lengthy bank review. Cigno may be able to find a provider that can help you.

Our online portal is available 24/7 so you can access us anywhere, anytime.

Life doesn't stop during the weekend and neither does Cigno. We operate 7 days a week.

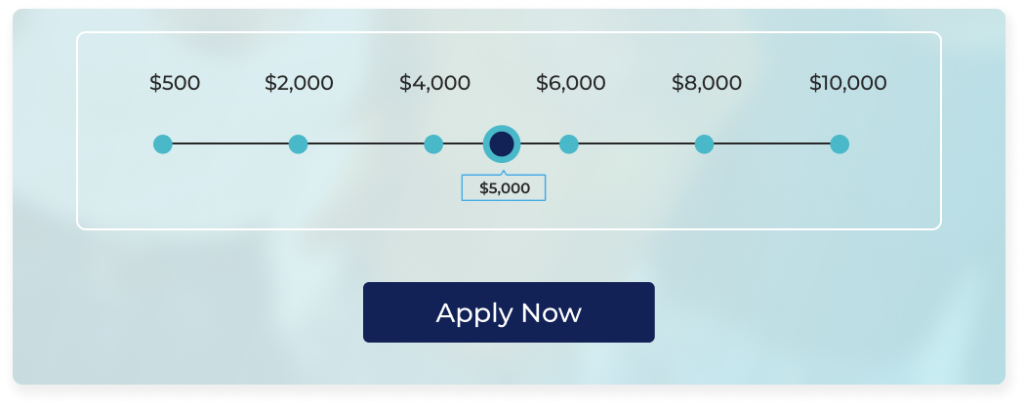

Cigno can connect you with a provider who may be able to assist you with loans from as little as $500.

Looking for some quick cash to pay off urgent expenses? Get the money you need and pay it off quickly.

Cigno may be able to connect you with a provider who can help you.

Have you got unexpected medical costs or are your latest bills higher than you anticipated? A pensioner loan could be the answer to your financial situation.

Easy loans when you need it.

For years, Cigno has been a household name in emergency cash solutions. Now, we look to help connect you, through our network, with a business who may have a financial solution to suit you.

To get started, fill out Cigno’s information form.

To learn more check out How It Works and About Us.

No, but with your permission we will share your information with our network to try and help you find a suitable financial solution.

Cigno is available online 24/7!

You can find all the information you need on our Contact page.

No, Cigno will try to connect you through our network for no charge to you. Cigno may receive a fee from our intermediary partner(s) for assisting them in connecting you to our network.

Anywhere, anytime! We offer a 24/7 online platform!

Please consider your own circumstances before you use Cigno. Please make sure you read our Privacy Policy, Terms and Conditions and this Financial Risk Disclaimer.

Cigno is a business name of FTA Data Solutions Pty Ltd ABN 95 670 814 221.

FTA Data Solutions Pty Ltd is an Authorised Credit Representative (Credit Representative No. 552387) of Finance & Loans Direct Pty Ltd Australian Credit Licence No. 390166.

Cigno is not a credit provider or a credit assistance provider. When you complete the Information Form, you are not applying for credit or any other particular goods and services. The completion of our Information Form also does not guarantee that you will be provided with credit or any other goods and services through our network.

Depending on the information you provide to us in the Information Form, we endeavour to assist you by providing your information to our intermediary partners. Where we provide your information to our intermediary partners, we may receive a fee.

If the information you provided to our intermediary partners meets their requirements, they may connect you with a credit provider, goods and/or services provider and/or specific products to meet your their needs (depending on the information your input into the Information Form).

Any application you ultimately make through a particular credit provider or goods and/or services provider is subject to that provider’s eligibility criteria and terms and conditions. The loan, credit, product or service may not be available to every person. We do not endorse or recommend any particular provider, product or service that you be connected with or offered. All statement on this website are general in nature and do not constitute financial, credit or legal advice (or any other advice).

SMS: 0429 213 774

Email: [email protected]

Post: PO Box 1810, Southport BC, QLD 4215

ABN: 95 670 814 221

The loan value in which you may be lent via our network is dependant on your current income and expenses. Through our network, you may be able to access loans between $500 and $10,000.