How do you manage your money? Do you manage your money at all? From writing down your expenses to setting up Excel spreadsheets, there are countless ways to stay on top of savings and spendings. But, we are in the digital age now. Everything is at our fingertips.

More and more Australians are using money management apps for their convenience of use and accessibility. Let’s take a look at the best money management apps for Australians.

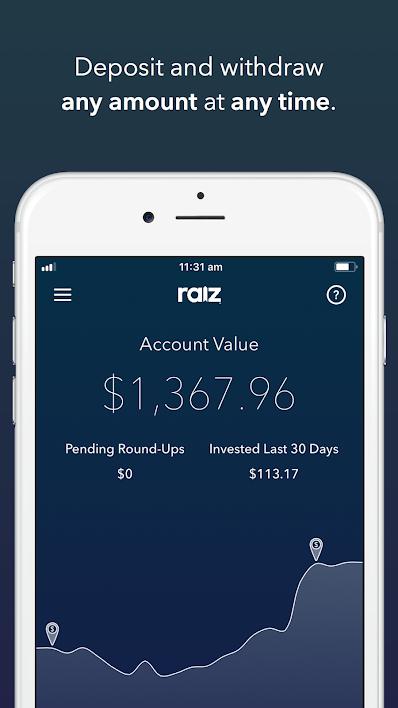

Raiz Invest

Cost: App is free but there is a monthly fee ($3.50 per month for balances under $15,000)

Availability: Android and iOS

Raiz Invest is an investment app that links to your bank account. When you spend, Raiz rounds up your transaction to the nearest dollar and invests that change for you in a diversified portfolio (EFT) at your chosen level of risk. As this is an investment portfolio, it is subject to market fluctuations. You will also need to pay tax on all realised capital gains.

Features:

- Choose from 8 investment portfolios based on risk

- Get a percentage back on your shopping via Raiz Rewards loyalty program

- Less risky alternative to investing in stocks

Splitwise

Cost: Free

Availability: Android and iOS

Splitwise isn’t Australian, but still useful for those people who need to split expenses. Great for flatmates who need to keep track of who owes what. Splitwise keeps a running total of how much is owed and it also emails reminders when expenses like the rent are due or when you forget to pay someone back.

Features:

- Split household expenditures with your roommates

- Keep track of random IOUs, apartment bills, group trips, etc. with email notifications

- Everyone can log in, see their balances, and add new expenses

Expensify

Cost: Free

Availability: Android and iOS

Expensify allows you to scan receipts and track time or mileage for tax deductions. What’s cool about Expensify is that it pulls information from the receipts including date, time, amount, and merchant and puts it all into a CSV file ready for your accountant at tax time. Expensify also categorises and codes each receipt and submits business expenses for approval and reimbursement.

Features:

- Tracks and submit receipts and expenses in any currency

- Mileage and GPS tracking for car and travel deductions

- Accounting integrations with QuickBooks, Xero, NetSuite, Intacct, and more

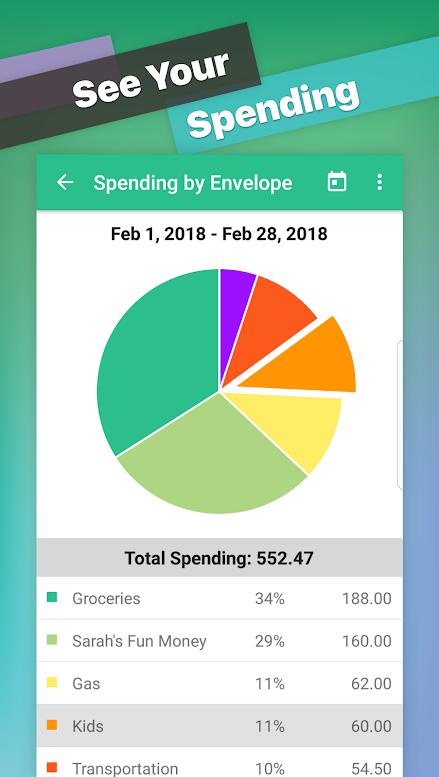

Good Budget

Cost: Free (Upgraded version $8.00 per month/$70.00 per annum)

Availability: Android and iOS

This app uses a virtual version of the old-fashioned envelope system to help you budget your money. Track expenses, monitor savings goals, sync with your partner, monitor cash flow and analyse spending patterns. Managing your budget has never been easier with the proliferation of apps and mobile tools available.

Features:

- Syncs and shares household budgets across all devices

- Let’s you plan ahead and be prepared for big expenses

- Tracks your debt payoff progress while still setting aside money for other things

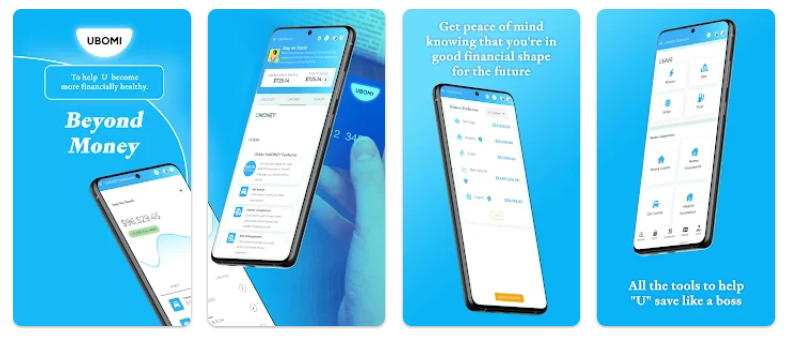

UBOMI

Cost: Free (Upgraded versions from $7.00 to $20.00 per annum)

Availability: iOS and Android

UBOMI provides all the tools you need to help you with your financial goals. With effortless function, UBOMI puts you in the driver’s seat. Set and accomplish your goals, rid yourself of debts, and see your progress along the way. Credit cards, loans, mortgage payments, superannuation – UBOMI populates all your finances into an easy-to-manage space.

Features:

- Connect all your accounts into a consolidated view so you know where you stand.

- Categorise your spending to manage all your incomings and outgoings

- Create a specific budget and track your progress against any short and/or long-term financial goals you’ve set

Why is a Good Expense Tracker App Important?

Tracking is a great way to monitor your spending. Using a good finance app or expense tracker will encourage you to change your financial habits for the better. The best budget apps on the market will show how much you’re spending and alert you if you’re going over.

The expense tracker app that you decide to use should analyse both your income and expenses and is adaptable enough to adjust to achieve your savings goal, among others. Whether you are preparing your monthly budget and sticking to it, or gathering purchases to top up your savings account, a money management app can help.

Which App is Right for You?

While all are great, some have various options that may better maximise your ability to save. The best part is, most of these apps are free, so it’s as simple as downloading one and trying it out.

Remember, if experiencing financial difficulty, Cigno can be a source of assistance. We offer same-day loans to those in need, regardless of the situation you find yourself in. Got a bad credit rating? No problem. We have a quick and painless application process, as well as a high approval rate for all borrowers. Everyone needs a hand from time to time, and we are here to help you land on your feet.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.