[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text]Saving money isn’t easy. Whether finances just aren’t your forte or you’re just learning how to manage your money on your own, you probably have questions about how to save money.

Would you like to take your money management on the go and get cheap financial advice? Luckily, we have different apps to help you manage your money wherever you are. Here’s a list of the best money saving apps in Australia.

Budgeting Apps in Australia

In today’s environment, paper and pen are not the only tools you have to handle your finances. You don’t even necessarily need an accountant’s expertise to help you learn how to save money. If you want to learn to budget and save more, there are financial apps available for you.

While there are plenty of apps that can help you spend money — we’re looking at you, online shopping apps and games with in-app purchases, we have listed the best budgeting apps in Australia to help you save money.

If you’re trying to draw up your monthly budget and stick to it, there’s an app on this list for you. A budgeting app can take the hard work out of tracking your finances and make them look presentable.

MoneyBrilliant

- Standout features: Automatically categorise transactions; alerts for low balances and upcoming bills; tax-deductible suggestions; money priorities dashboard tailored to you; notifications about better deals

- Price: Free (basic version); $9.90/month or $99/year (MoneyBrilliant Plus)

- Available on: iPhones and Android phones

- Learn more about MoneyBrilliant

Moneytree

- Standout features: Keeps all your accounts, cards, super and cash amounts in one place; helps you view and analyse your spending habits with intuitive categories and graphics; also tracks loyalty points and rewards cards

- Price: Free, with optional monthly and yearly plans for paid services (Moneytree Grow and Moneytree Work)

- Available on: iPhones and Android phones

- Learn more about Moneytree

YNAB (You Need a Budget)

- Standout features: YNAB is a very flexible app, letting you make changes to your budget when you need to. YNAB proposes that with a change of mindset and technique, it can be easy to take control of your finances again.

- Price: Free trial

- Available on: iPhones and Android phones

- Learn more about YNAB

Round-Up Savings Apps in Australia

Remember putting loose change in a piggy bank? Many of those piggies only collect dust now, since most transactions are digital, but there’s a new way to put aside your spare “coins”.

When it comes to apps that round up purchases, Australia is still catching up to other countries. But we do have a few good options to choose from:

Sipora

- Standout features: Rounds up debit card purchases to the nearest $1, $2 or $5; large selection of stores to spend your savings on including Glassons, Vans, The Good Guys and many more

- Price: Free

- Available on: iPhones and Android phones

- Learn more about Sipora

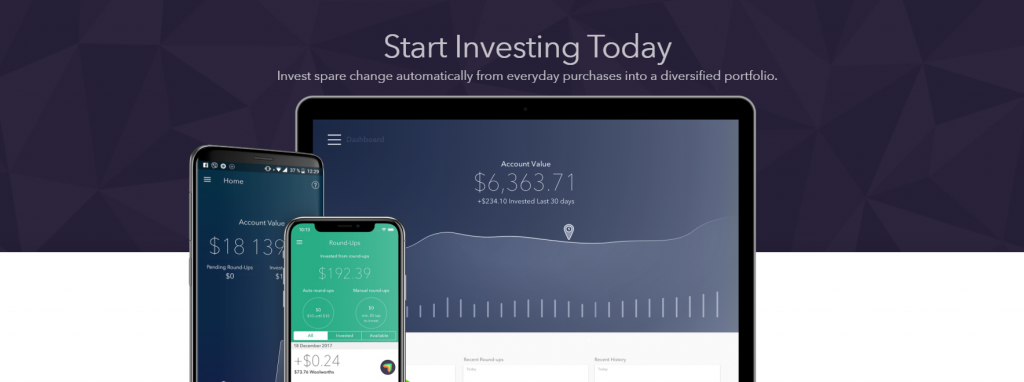

Raiz

- Standout features: Invests your everyday spare change into a diversified portfolio; choose from 6 portfolio types ranging from conservative to aggressive; unlimited deposits and withdrawals

- Price: $2.50/month (accounts below $10,000) or 0.275% per year (larger accounts)

- Available on: iPhones and Android phones

- Learn more about Raiz

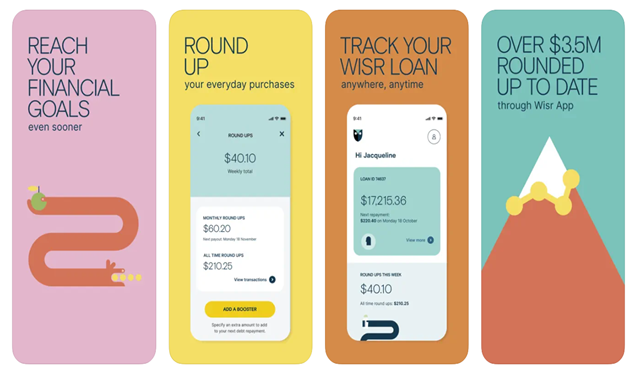

Wisr

Standout features: Stay on top of your credit scores. Link any bank. Automatically “Round Up” your purchases to the nearest dollar. Access your loan info anywhere, anytime.

- Price: Free

- Available on: iPhones and Android phones

- Learn more about Wisr

Free Money-Saving Apps

Don’t have time to record your finances the old fashioned way? These free budgeting and money-saving apps are worth considering as contenders for the title of best free money saving apps.

Splitwise

- Standout features: Great for organising and tracking shared expenses (e.g. with housemates, travel groups and family); adding expenses is easy; in-built system for sending online transfers and recording cash payments

- Price: Free, with optional paid subscription for premium features (e.g. receipt scanning and currency conversion)

- Available on: iPhones and Android phones

- Learn more about Splitwise

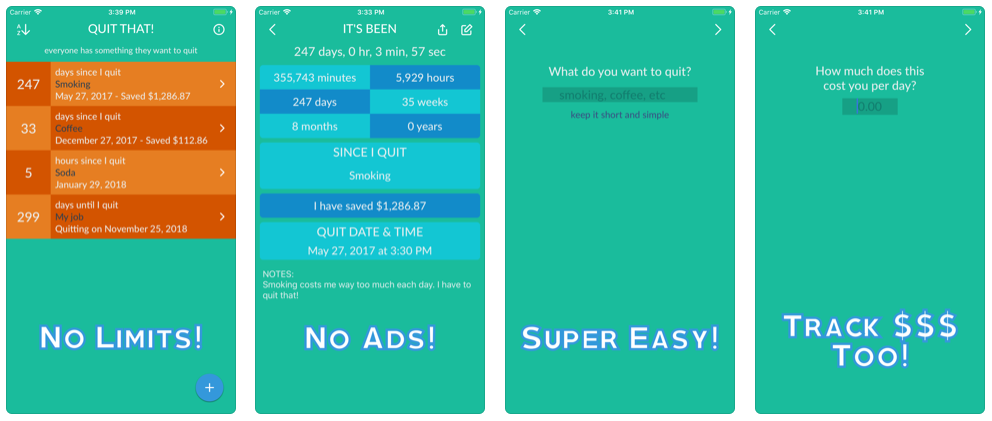

Quit That!

- Standout features: Tracks how much money you’ve saved since quitting alcohol, smoking, or any other expensive habit; records time since quitting as well

- Price: Free

- Available on: iPhones and Android phones

- Learn more about Quit That!

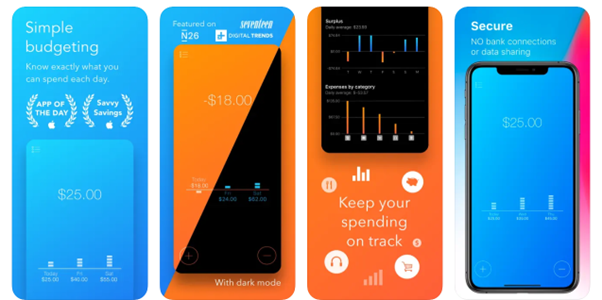

Daily Budget

- Standout features: With the Daily Budget app, you can easily control your daily spendings based on your income and expenses.

- Price: Offers in-app purchases

- Available on: iPhones and Android phones

- Learn more about Daily Budget

Don’t forget to explore your bank’s free app before exploring other options. It might have all the budgeting tools and support you need.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.

[/vc_column_text][/vc_column][/vc_row][vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][image_with_animation animation=”Fade In” hover_animation=”none” alignment=”” border_radius=”none” box_shadow=”none” image_loading=”default” max_width=”100%” max_width_mobile=”default”][/vc_column][/vc_row]