University life is expensive, so knowing how to budget your money is more important than ever before. For some, being at university is the first time living out of home, which comes with a lot of new expenses and responsibilities. If you’re not sure how to budget as a uni student, we have some answers for you.

How to Make a Student Budget

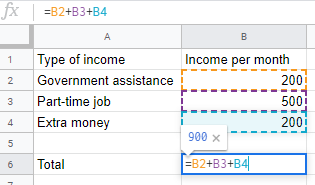

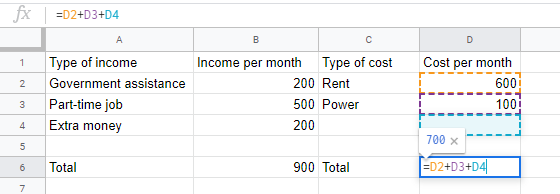

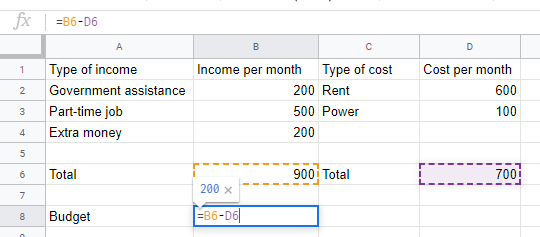

It’s not exciting, but the easiest way to get a solid understanding of your finances and your budget is to start with a spreadsheet. You can make use of the built-in formulae within Google Sheets and Microsoft Excel so that you don’t have to calculate your spending allowance yourself.

Within one column, input all your income – your part-time job, your government assistance, money from family, whatever you have it goes there. Then you can easily add it up using the built-in sum formula.

After that, you can input all your expenses or costs, and add up the total.

Finally, that should bring you to your total, remaining budget.

Budgeting in a spreadsheet is the easiest way to fully understand your spending potential each month, week, or year.

No matter how much or little your income and expenses are, log them all. No one has to see this spreadsheet except for you, so feel free to include everything. You can duplicate the sheet and have a different tab for each month so that you never forget anything.

If a big spreadsheet isn’t your preferred method, there are a lot of mobile apps you can access that will help you keep on track as well. Just remember to start a budget and stick to it.

How to Budget at Uni and Save Money

The reason students should write down their budget is so that they don’t go over their budget and accidentally spend too much money. You don’t want to spend so much you can’t pay rent, though if you do find yourself in that position where you can’t make ends meet, a short-term loan might be able to help get you out of a sticky situation.

When looking at how to make a student budget, you first need to consider the things you must pay for: rent, bills, groceries, etc. Then the things that would enrich your life: a physical copy of a textbook, a backpack to make getting around campus easier, a protective case for your laptop, etc. Finally, consider the things you’d like to have but don’t need: a nice new shirt, new sunglasses, a cup of coffee, etc. Keeping this hierarchy will make budgeting simple and make life easier for anyone wondering how to budget for students.

No one wants to give up all the fun of being young at university, and with a stable budget that keeps you in control of your finances, you won’t have to.

How to Expand Your Budget

Sometimes your budget as a uni student is a little too tight and you need to expand it a bit. There are generally two ways to expand a budget.

The first is to cut down on any unnecessary spending – anything at all that you don’t strictly need.

The other option is to make more money. If you don’t already have a part-time job or you want to get another, there are plenty of options available to uni students – from tutoring high-school students (their parents are sure to pay you more if you’re getting your degree in a relevant subject) or doing odd jobs around town. Check to see if there’s a corkboard anywhere on campus with a listing of these kinds of jobs. Or check out Australia’s top money-making apps to make some extra cash.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.