Online shopping has plenty of advantages: it’s fast, it’s easy, and it’s convenient. When you think of something you need or want at midnight, you can click a few buttons and buy it instantly – no relying on yourself to remember when you wake up the next morning!

But the things that make online shopping so good are the same things that make it dangerous. Online shopping addiction is just as prevalent as in-person shopping addiction, affecting roughly 5-8% of people. In some ways, online shopping can become compulsive even more easily than physical retail therapy, because we:

- Get to stay anonymous (fewer shame triggers)

- Can make purchases 24/7 (including at times when we naturally have less willpower)

- Have access to a massive variety of stores and products at our fingertips.

So, is it OK to keep adding to your cart? Maybe – as long as you’re staying within your budget and you know how to save money online shopping.

These online shopping tips to save money could help you keep your internet spending under control.

Cashback Websites and Coupons

The eCommerce space is highly competitive, which is why many retailers go to extreme lengths to earn your purchases. One way some sites do this is with cashback schemes, where they get a commission from your purchase (from the actual seller) and share part of that commission with you.

You essentially get the same product you were going to buy anyway, but you purchase it through a third party that refunds a percentage of the price (anywhere from 1% to 30% but usually around 5%) back to you (sometimes as a gift card or coupon).

Some of the top cashback sites in Australia, as ranked by Aussie Money Mum, include:

The Shopping Cart Trick

Have you ever abandoned your shopping cart after loading it with items, only to be hit with an email offering a discount on those products? Plenty of retailers use this tactic to close the deal, so you can turn the tables by intentionally leaving sites without completing your transactions.

If they don’t try this strategy to get you back within a day or two, just jump back in and complete your order anyway – no harm in trying!

Seasonal Sales

Unless you need a product urgently, it’s usually a smart idea to wait until a seasonal sale to snag it at the best possible price. If EOFY, Boxing Day, Cyber Monday or a Click Frenzy date is approaching, hold off a bit to avoid missing out on a bargain.

The same mentality can also be applied to seasonal products. Get a great deal on warm clothes when winter is wrapping up, or pick up some cheap beach toys and towels at the end of summer. This is a great way to save money online shopping as well as when shopping in stores.

Sign Up for Email Newsletters

This is one of our simplest online shopping tips to save money. Some online stores will give you an introductory discount just for subscribing with your email address, so keep an eye out for this offer.

They might follow up with exclusive offers via email, too. If they don’t, or if you find the email marketing tempts you to indulge a little too much, simply scroll to the bottom and unsubscribe.

Get Tech-Savvy

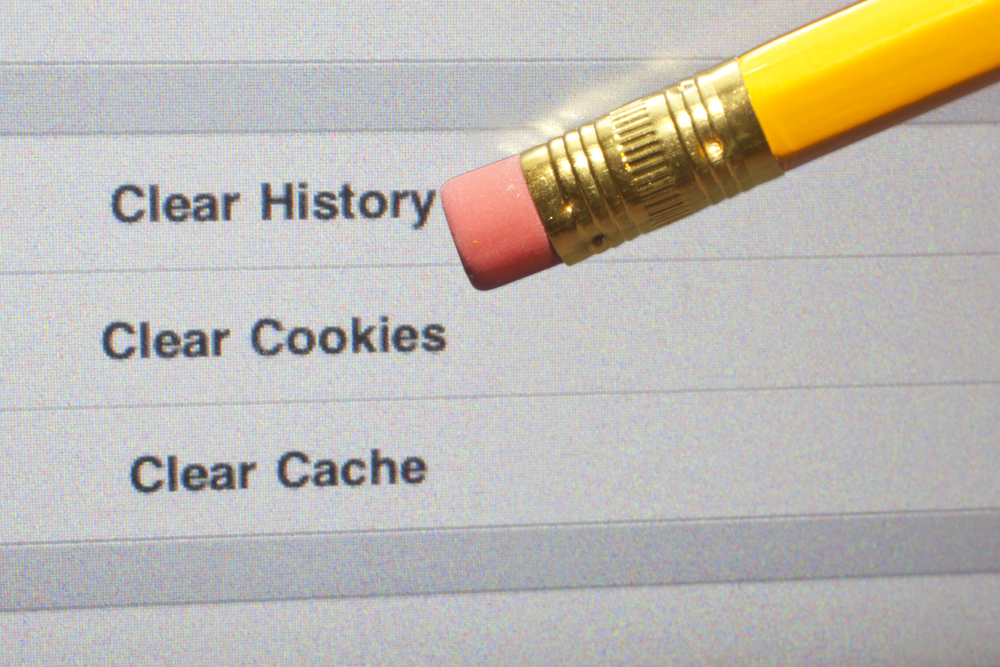

Websites often use “cookies”. These aren’t the delicious, chocolate-chip sort. No, these cookies are digital trails you leave that reveal your online browsing and purchasing behaviour.

With this information, some sites might raise prices on items you frequently browse and/or buy. You can negate this risk by regularly clearing your browsing data, ensuring every website treats you as a fresh customer.

Do Your Research

Just like shopping in person, it never hurts to compare prices before committing to a purchase. In fact, comparison shopping is nice and easy online – no walking or driving required. Just Google the item you’re after, then open the top few results in their own tabs to see their prices side by side.

Don’t forget to take varying delivery costs into account when comparing costs online.

Shop at Home, Pick Up in Store

Unless you get free shipping from a retailer, delivery costs can quickly add up when you’re shopping online. When you have the option and the ability to do so, consider choosing Click & Collect instead to save on costs while still enjoying the convenience of browsing online.

We hope these online shopping tips for saving money have given you some fresh ideas to keep your internet spending sprees within reason. If you need urgent money to buy something online, a quick cash loan up to $1,000 might be helpful – and you can apply with us 100% online as well.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.