Tracking is a great way to monitor your spending. Using a good finance app or expense tracker will encourage you to change your financial habits for the better.

The best budget apps on the market will show how much you’re spending and alert you if you’re going over. While these apps automate a lot of work to replace the pen-and-paper method, they also help you be more proactive in budgeting.

The Best Budgeting Apps Listed in Order Below

Some of the best budget apps in Australia are MoMa Services, Expensify, Pocketbook, and Splitwise. All these apps have many similarities, but what sets them apart from each other are their defining features.

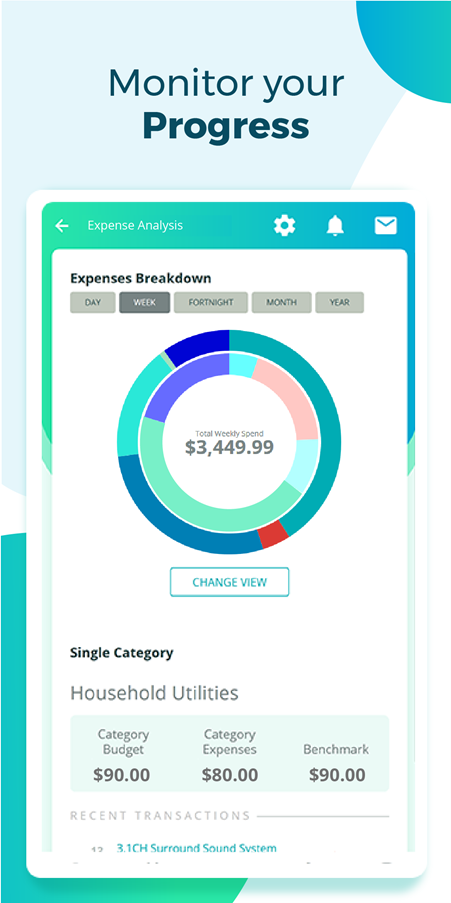

MoMa Services

MoMa Services provides all the tools you need to help you with your financial goals. With effortless function, MoMa puts you in the driver’s seat.

Set and accomplish your goals, rid yourself of debts, and see your progress along the way.

Connect all your accounts to know where you stand. Credit cards, loans, mortgage payments, superannuation – MoMa populates all your finances into an easy-to-manage space.

Through smart advice and notifications, you’ll be given an easy-to-follow guide to your goals. MoMa takes out the guessing game by integrating upcoming bills with your savings plan so you are aware how much you can still spend.

So much spending goes unnoticed and unplanned. MoMa lets you cut needless costs — saving you money, time, and hassle in the long run!

Features:

- Connect all your accounts

- Categorise your spending

- Manage all incoming and outgoings

- Create a specific budget and track your progress

- Set short and/or long-term financial goals

- Manage your finances

- Financial tips

- Free services with upgrades.

MoMa Services is available through iOS and Android.

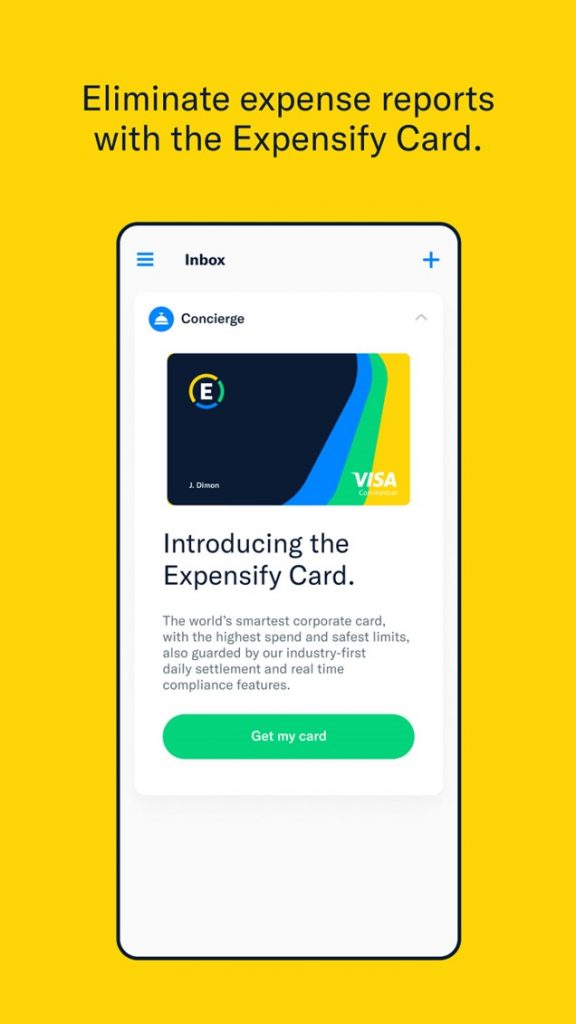

Expensify

Expensify (receipts & expenses app) helps to easily track your receipts and manage expenses on the go. Take a photo of any receipt and Expensify automatically transcribes its details.

Expensify also categorises and codes each receipt, and submits business expenses for approval and reimbursement.

Features:

- Tracks and submit receipts and expenses

- Mileage and GPS tracking

- In-app purchase

- Next-day direct deposit reimbursement

- Automatic credit card import

- Works with receipts in any currency

- Corporate card reconciliation

- Candidate reimbursement

- Per diem functionality

- Accounting integrations — QuickBooks, Xero, NetSuite, Intacct, and more!

Download the Expensify app for iOS or Android.

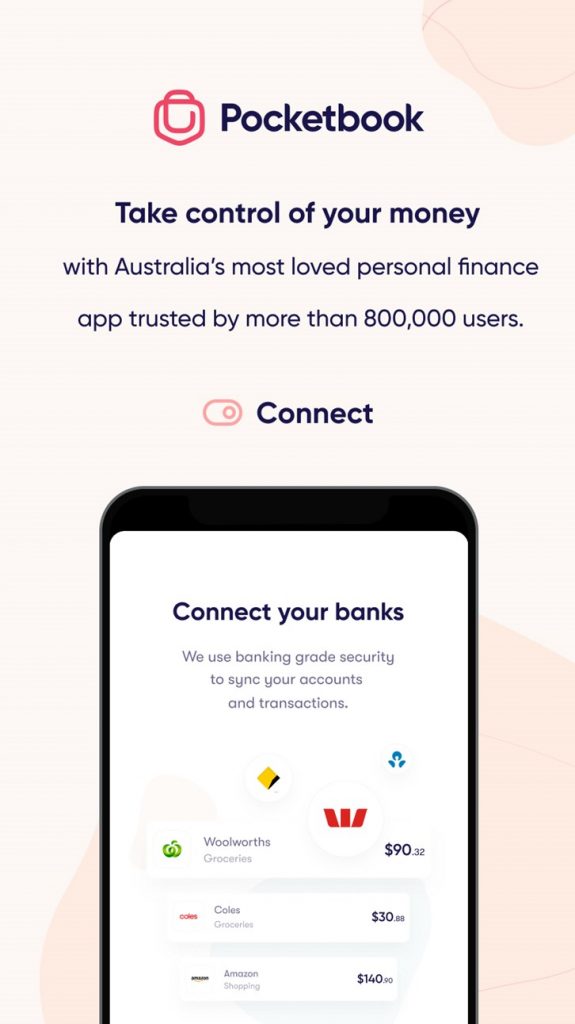

Pocketbook: Easy Budget Planner

Pocketbook: Easy Budget Planner is a budget planner and money and expense manager. The app has been designed to make personal finance, expense tracking, and budget planning easy for y

Pocketbook is the only personal finance app that allows you to synchronise with Australian banks. Pocketbook can auto-sync with a number of Australian banks including ANZ, AMEX, Bankwest, Bendigo Bank, Commonwealth Bank, ING Direct, NAB, St George, Suncorp, and Westpac.

There’s also an option to export your bank’s feed and upload it to Pocketbook in bulk for unlisted banks.

Pocketbook Money management features:

- No more missing bills and late fees. Get notified when they come up and if you have enough money for it

- Organise your personal finance and plan future budgeting in a single financial app and organiser

- Alerts via push notifications through the app and when you need them to stay in control of your income.

Download the Pocketbook app for iOS or Android.

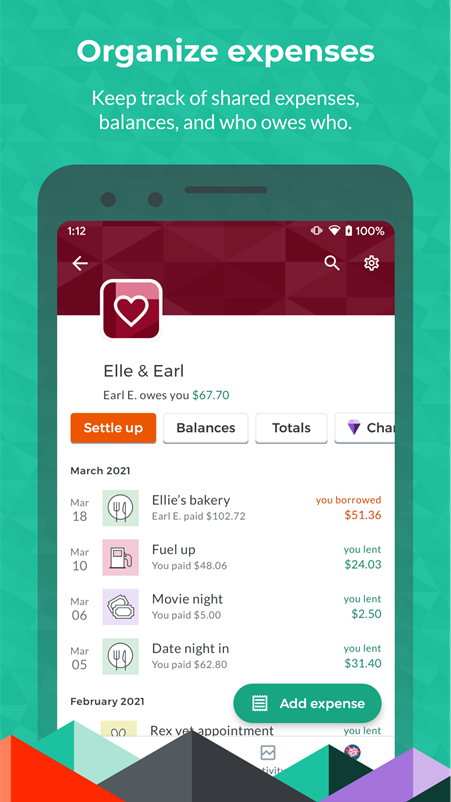

Splitwise

Splitwise is a bill-splitting app and the best way to share bills and IOUs to make sure that everyone gets paid back. You can view your balances on your smartphone or on the Splitwise website.

Use Splitwise to:

- Set up email notifications for bills.

- Split household expenditures with your roommates.

- Serve a reminder when a friend spots you for lunch.

- Keep track of random IOUs, apartment bills, group trips, etc.

- Figure out costs of your group vacation.

- Everyone can log in, see their balances, and add new expenses.

- Get notified with every update, or just when bills are due.

- Track spending trends, and so much more!

Splitwise is applicable for iOS or Android.

Why is a Good Expense Tracker App Important?

The expense tracker app that you decide to use should analyse both your income and expenses and is adaptable enough to make adjustments in order to achieve your savings goal, among others.

Whether you are preparing your monthly budget and sticking to it, or gathering purchases to top up your savings account, the aforementioned apps are listed for you to help you meet whatever you need to.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.