Dos and Don’ts – Applying for a Centrelink Loan

There are many benefits to getting a Centrelink loan. One of which is to use the funds in debt consolidation to pay off your existing debt. For borrowers who are currently receiving benefits from Centrelink, they may find it difficult to get a loan. We run through the ‘dos’ and ‘don’ts’ when it comes to […]

Cheap Activities To Do These Holidays

Your kids will want to have fun these coming holidays, but the economy might not cooperate. Why don’t you have some fun activities to do that won’t break the bank at the same time? Here are cheap and fun activities the family will love to do these holidays. Make cards for Christmas You can make […]

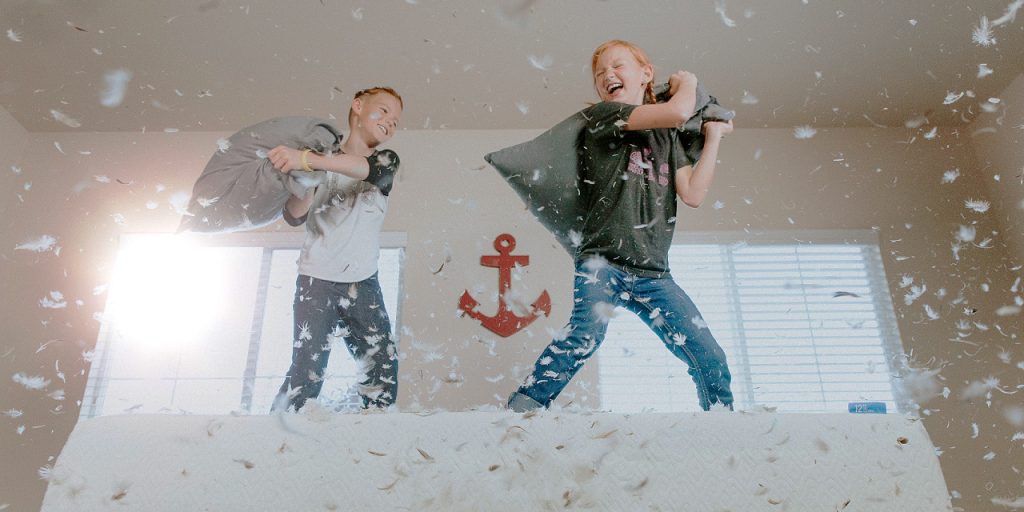

Cheap School Holiday Ideas with The Kids

“Mum, I’m bored!” Are you wondering what to do with kids these school holidays? While camping out and going to the beach to swim are common, you can do other cheap & fun activities too! Here are some suggestions that will surely excite the kids and make lasting memories. Fun competitions at home Hold a […]

Cash Loans With No Credit Check – How Do They Work?

Cash loans can be very helpful in situations where you’re running low on money and need funds fast. In this article, we’re going to explain some of the factors that make cash loans with no credit check so well suited to those in desperate financial circumstances. Heard about payday loans before and want to learn […]

Top Facts About Cash Loans For Bad Credit

You’ve run out cash and need a loan to make it to your next payday. Do you ask friends, apply for a new credit card or take a payday loan? If speed and avoiding a credit check are at the top of your priorities list, a payday loan could be your best move. In this […]

Can You Get A Loan While On Centrelink Benefits?

When it comes to lenders determining a borrower’s suitability for a loan, they usually look at various criteria such as income, expenses, and credit history. For those who receive Centrelink payments, they may be wondering if getting approved for loans for people on benefits is possible since they relatively have a low income. Can I […]

4 Things You Should Never Do With A Cash Loan

More and more of us are spending too much and saving too little. There are now loads of ways for people to run short on money month-to-month. Whether you have a family household to look after or you live in your own place, when money is tight, a fast cash loan could be your best […]

How a Cash Advance Can Help You After a Disaster

In 2017, the Australian Bureau of Statistics released a statement claiming that that nearly 1 out of every 3 Australian households was over-indebted. That number that has grown by 8% from 2003 – 2016. Being in debt is difficult on its own, but imagine being in debt when a natural disaster strikes. Earthquakes, floods, destructive winds, road […]