What is micro-investing?

With micro-investing, you invest small amounts of money to build an investment balance. If you constantly make small contributions over time, you can earn more — more than if your money is in a savings account.

Say, with your debit card, you purchase something for $4.70. The total purchase amount is $5 as it’s rounded up. The 30 cents goes into your investment fund — small amounts that add up to a considerable investment balance over time.

What you can also do is to set up a regular recurring investment or deposit lump sums into your investment fund. These are then invested into a portfolio of shares or low-cost exchange traded funds (ETFs).

You can monitor your account balance through apps or online.

There are fees involved in micro-investment namely brokerage fees, subscription or management fees, cancellation fees, withdraw fees, transaction fees, and account opening fees, among others.

Micro-investing in Australia?

Micro-investing is still quite new in Australia. There are some spare change apps now for Aussies, which let them invest small amounts at a time into the stock market. Check these apps below.

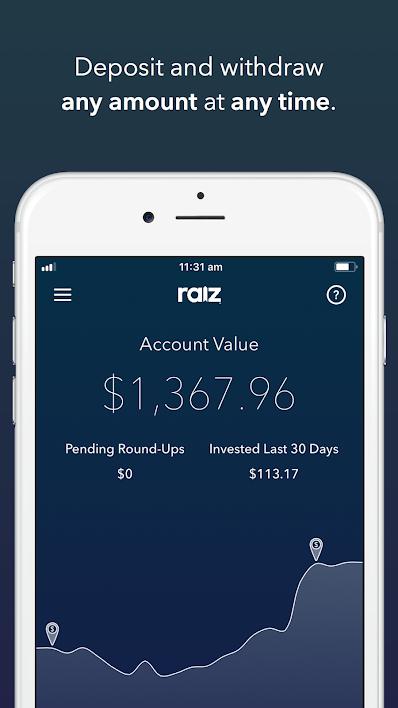

Raiz Invest

Raiz Invest helps you save & invest starting with virtual spare change from your everyday purchases and invest this into a diversified portfolio of stocks and bonds. You can easily get started in minutes: anytime, anywhere.

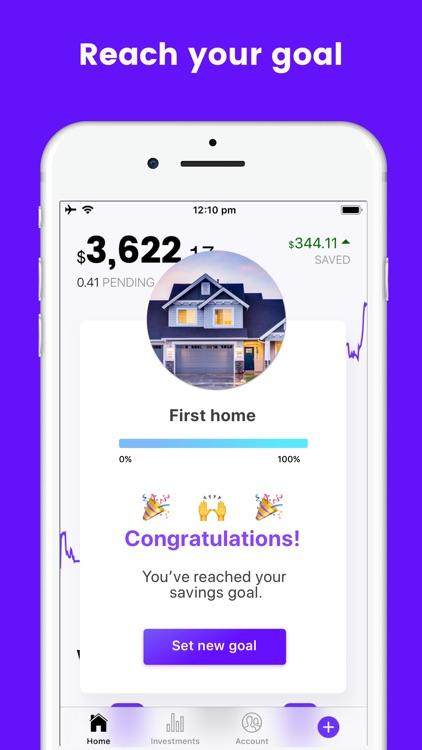

FirstStep

Need help saving? FirstStep helps you automatically save and invest your loose change.

Features

- Open an account in minutes

- Set a goal and track your progress

- A professional investment account

- Build a personalised and invest in Tech, Ethical, Asia and Health trends

- Automatically invest loose change from everyday purchases

- Set recurring deposits as low as $5

- Check your account value from anywhere in the world

- Withdraw to your bank account at any time

- Automatic spend categorisation (Beta)

- Timely investment notifications

- Fast and friendly support via chat

- Tips and tricks to help you become a pro with money

[Tweet “Ways To Micro Invest Your Tax Return”]

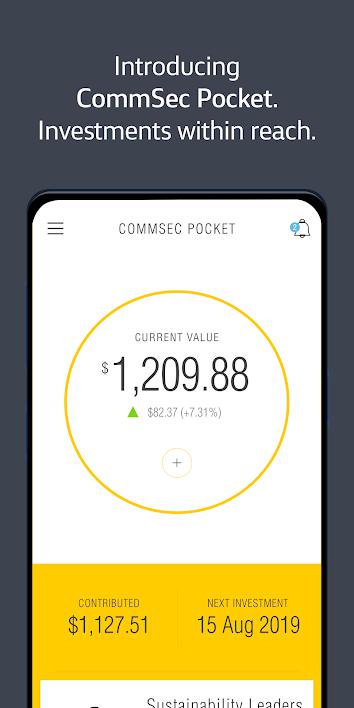

CommSec Pocket

CommSec Pocket lets you invest anytime, anywhere, with as little as $50. Choose from seven themes to easily invest in something that appeals to you — like tech, sustainability leaders, or the biggest 200 companies on the Australian market.

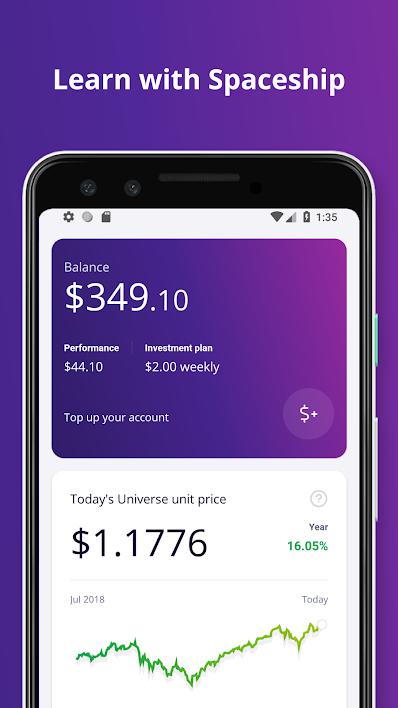

Spaceship Voyager

Spaceship Voyager is an investment product designed to help you to invest and build wealth. There is no minimum investment and no fees on your first $5,000 invested. Spaceship Voyager makes investing simple, accessible and affordable for everyone.

Quick loans in Australia

In case you find your cash won’t suffice to cover the bills, you can apply for quick loans online in Australia.

With Cigno Loans, get up to $1,000 paid directly into your account.

The online application makes the process fast and simple. Hence, fast turnaround time and approval for borrowers with urgent needs.

Cigno can help you to apply for quick loans, which can be repaid over a lesser time period.

Disclaimer: Please be aware that Cigno Loans’ articles do not replace advice from an accountant or financial advisor. All information provided is intended to be used as a guide only, as it does not take into account your personal financial situation or needs. If you require assistance, it is recommended that you consult a licensed financial or tax advisor.