The Different Types of Small Loans Explained

Sometimes unexpected bills and purchases airs such as medical bills or car expenses. This is where taking out a loan can help. But first, you’ll need to understand the types of loans offered in the market because specific loans are suitable for certain purchases. There are many variables to consider when looking at different types […]

Dos and Don’ts – Applying for a Centrelink Loan

There are many benefits to getting a Centrelink loan. One of which is to use the funds in debt consolidation to pay off your existing debt. For borrowers who are currently receiving benefits from Centrelink, they may find it difficult to get a loan. We run through the ‘dos’ and ‘don’ts’ when it comes to […]

Vital Factors To Look For When Searching For Fast Loans

Running low on cash? One of the most convenient things you can do is apply for a fast loan that will give you the cash you need. In this article, we want to help you understand what to look out for when searching for fast loan options so that you can keep your head above […]

How To Get An Instant Cash Loan Online

[vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none”][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text]When life throws you a curveball and you find yourself urgently needing cash, you obviously want it in your account […]

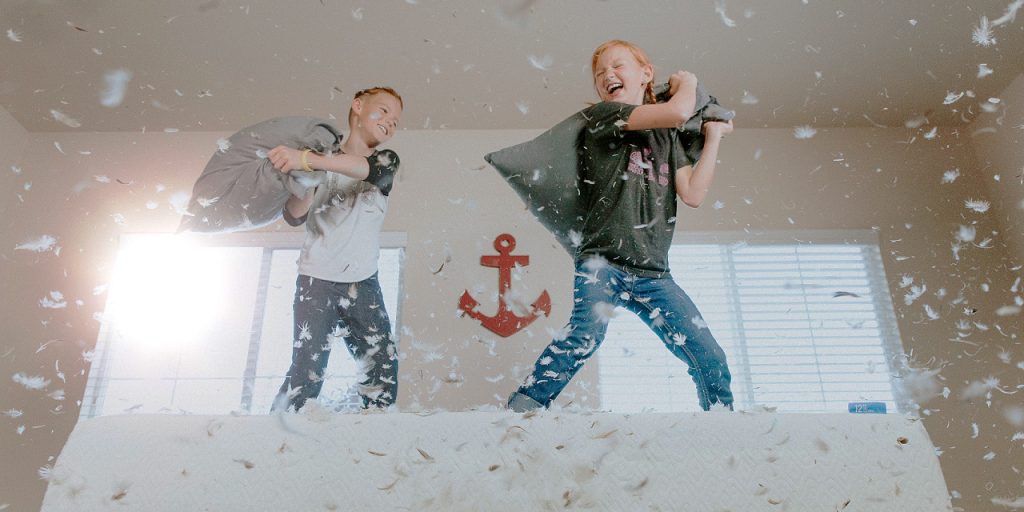

Cheap Activities To Do These Holidays

Your kids will want to have fun these coming holidays, but the economy might not cooperate. Why don’t you have some fun activities to do that won’t break the bank at the same time? Here are cheap and fun activities the family will love to do these holidays. Make cards for Christmas You can make […]

How Does a Cash Advance Work?

Even in today’s almost-cashless economy, there are still situations where you might find you need “real” money. From strolling through market stalls to picking up some furniture from a local on Gumtree, there are times when physical cash creeps its way back into circulation. But what can you do when you typically tap or click […]

Why Fast Easy Loans Are Increasing in Popularity

Once in awhile you need to catch up on your expenses, however, you don’t have an emergency fund. You might want to look into fast cash loans. What is a fast cash loan? A fast cash loan is essentially a cash advance. Based on your lender, your income, and your credit history — this type […]