Ways To Pay Down Your Holiday Debt

Have you overindulged over the holiday period? It’s hard to start the year when you have post-holiday debt to deal with. It’s time to get back into your normal spending routine after spending more on events and parties during the holidays. Take control of your finances now before it snowballs into a debt crisis all […]

Ways To Stretch the Holiday Budget Further

The holidays are fun and during this time, it’s easy to forget about your budget and splurge. Wondering how to stretch the budget further after you’ve had a holiday blowout? The festivities can continue throughout the year with some careful planning. The more preparation you put in, the more you’ll be rewarded. Here are ways […]

Ways To Cool Down Your House And Save Using The Air Con

The temperature in Australia can easily hit 30°C during the long summers. Thanks to air conditioning, you can retreat to a cool home. There’s a downside, though. As your AC unit works hard to quench the heat, your electric bill could spike. Now, there are simple and effective ways to cool down your home without […]

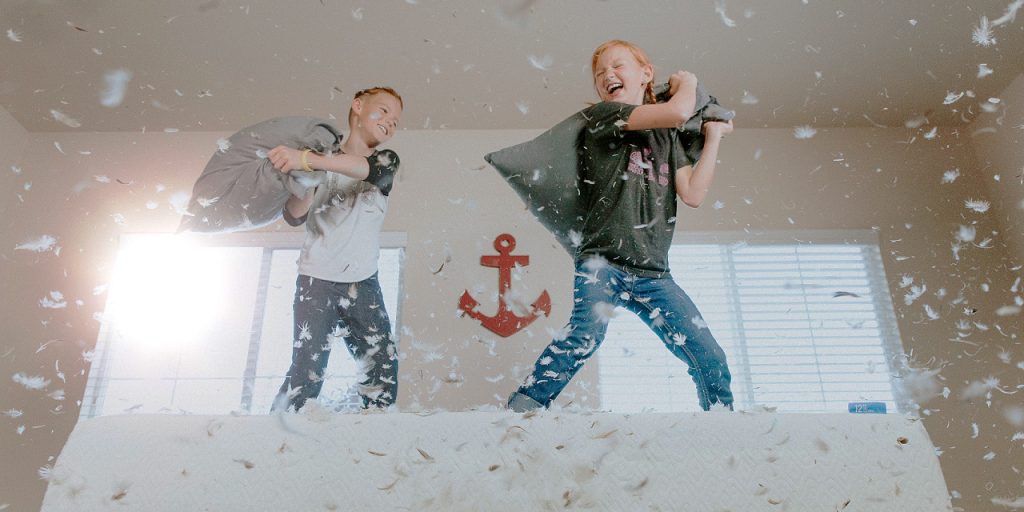

Cheap Activities To Do These Holidays

Your kids will want to have fun these coming holidays, but the economy might not cooperate. Why don’t you have some fun activities to do that won’t break the bank at the same time? Here are cheap and fun activities the family will love to do these holidays. Make cards for Christmas You can make […]

Ways To Save This Christmas

The Christmas season usually leaves you spent, both physically and financially. Instead, you should be relaxing with family and friends during the holiday, not battling the crowd and breaking the bank. Simplify things this year with these quick and easy tips to help you save and enjoy the holiday season. Pre-Christmas clean up “One person’s […]

Christmas Gifts Or Boxing Day Sales

In ecommerce, retailers get their pre-Christmas run in until the cut off. Before Christmas even happens, they will kick off their post-Christmas / Boxing Day sales. For retailers, Christmas is effectively over once the pre-Christmas delivery cut off past. “We always try to err on the side of being a bit conservative and once we […]

5 Easy Ways To Reduce Your Bills

Some small changes in your habits can better help with your savings, budgeting practices, and reducing your bills. Follow these tips! 1. Clothes When buying clothes, check if you can wash them yourself to avoid dry cleaning services. Make sure the clothes you buy can be mixed and matched so you can have more options […]

Ways To Micro Invest Your Tax Return

What is micro-investing? With micro-investing, you invest small amounts of money to build an investment balance. If you constantly make small contributions over time, you can earn more — more than if your money is in a savings account. Say, with your debit card, you purchase something for $4.70. The total purchase amount is $5 […]

Why Fast Easy Loans Are Increasing in Popularity

Once in awhile you need to catch up on your expenses, however, you don’t have an emergency fund. You might want to look into fast cash loans. What is a fast cash loan? A fast cash loan is essentially a cash advance. Based on your lender, your income, and your credit history — this type […]

Leasing vs Buying A Car

Have you ever bought a new car only to be told it would have been better if you had leased it instead? It can be hard to choose between leasing or buying a car because both have their advantages and disadvantages. Aside from access to a reliable car, leasing offers another huge advantage — a […]